Statistiques de base

| Actions institutionnelles (Long) | 26 354 981 - 16,41% (ex 13D/G) - change of -0,50MM shares -6,22% MRQ |

| Valeur institutionnelle (Long) | $ 531 347 USD ($1000) |

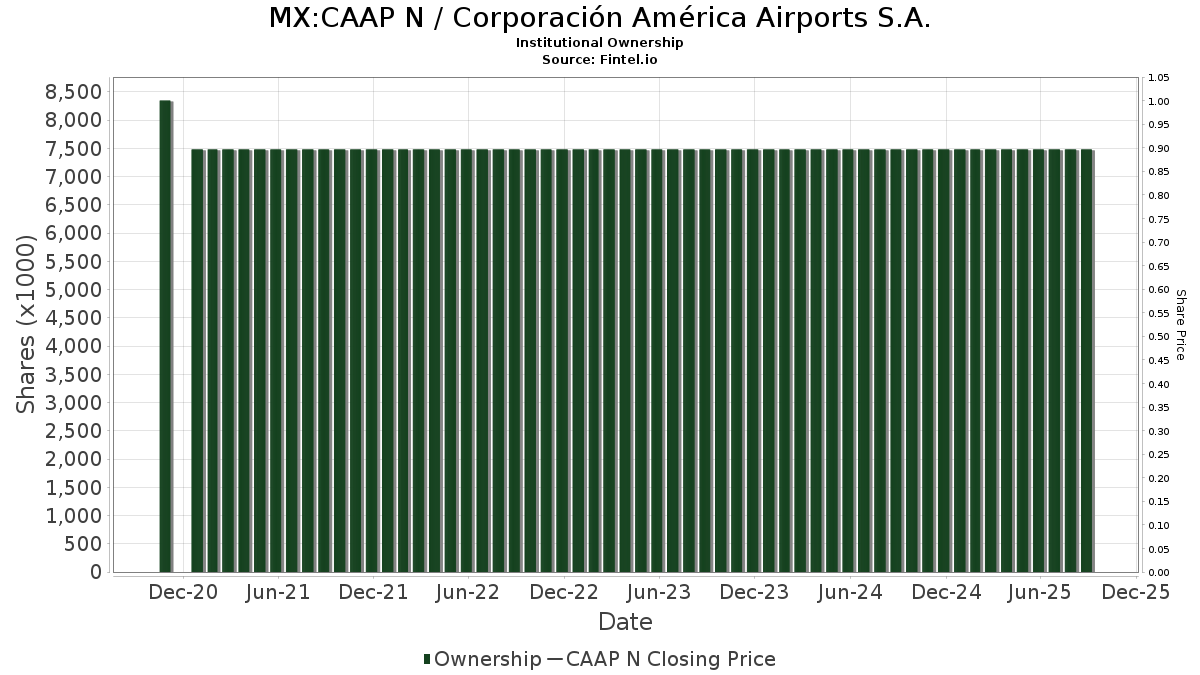

Participation institutionnels et actionnaires

Corporación América Airports S.A. (MX:CAAP N) détient 99 des propriétaires institutionnels et des actionnaires qui ont déposé des formulaires 13D/G ou 13F auprès de la Securities Exchange Commission (SEC). Ces institutions détiennent un total de 26,354,981 actions. Les principaux actionnaires incluent Helikon Investments Ltd, Fourth Sail Capital LP, Goldman Sachs Group Inc, BlackRock, Inc., IGF - iShares Global Infrastructure ETF, ARGT - Global X MSCI Argentina ETF, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., Royal Bank Of Canada, Jpmorgan Chase & Co, and Standard Life Aberdeen plc .

Corporación América Airports S.A. (BMV:CAAP N) la structure de l'actionnariat institutionnel indique les positions actuelles des institutions et des fonds dans l'entreprise, ainsi que les derniers changements dans le volume des positions. Les principaux actionnaires peuvent être des investisseurs individuels, des fonds communs de placement, des fonds spéculatifs ou des institutions. L'annexe 13D indique que l'investisseur détient (ou a détenu) plus de 5 % de l'entreprise et qu'il a l'intention (ou a eu l'intention) de poursuivre activement un changement de stratégie commerciale. L'annexe 13G indique un investissement passif de plus de 5 %.

Indice de confiance des fonds

L'indice de confiance des fonds (anciennement score d'accumulation de participation) trouve les actions qui sont les plus achetées par les fonds. Il est le résultat d'un modèle quantitatif sophistiqué à plusieurs facteurs qui identifie les entreprises avec les niveaux les plus élevés d'accumulation institutionnelle. Le modèle de notation utilise une combinaison de l'augmentation totale des propriétaires déclarés, des variations des allocations de portefeuille chez ces propriétaires et d'autres indicateurs. Le chiffre varie de 0 à 100, les chiffres plus élevés indiquant un niveau d'accumulation plus élevé par rapport aux autres entreprises, 50 étant la moyenne.

Fréquence de mise à jour : Quotidienne

Déclarations 13F et NPORT

Les détails des déclarations 13F sont gratuits. Les détails des déclarations NP nécessitent une adhésion premium. Les lignes vertes indiquent de nouvelles positions. Les lignes rouges indiquent des positions clôturées. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau

pour débloquer des données premium et les exporter vers Excel ![]() .

.

| Date de dépôt | Source | Investisseur | Type | Prix moyen (Est) |

Actions | Δ Actions (%) |

Valeur déclarée (1000 $) |

Δ Valeur (%) |

Allocation de portefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-06 | 13F | Metis Global Partners, LLC | 21 829 | 26,95 | 442 | 40,76 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 27 910 | 565 | ||||||

| 2025-08-28 | NP | Aberdeen Standard Global Infrastructure Income Fund | 249 500 | 0,00 | 5 055 | 10,71 | ||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 16 582 | -5,54 | 336 | 4,36 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 101 935 | 649,36 | 2 065 | 732,66 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 21 274 | 0 | ||||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 330 161 | -17,82 | 6 689 | -9,01 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 99 068 | -1,50 | 2 007 | 9,08 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 21 | 0 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 3 | 0 | ||||||

| 2025-08-11 | 13F | Rwc Asset Advisors (us) Llc | 82 327 | -26,64 | 1 668 | -18,80 | ||||

| 2025-08-26 | NP | IGF - iShares Global Infrastructure ETF | 954 187 | 21,38 | 19 332 | 34,38 | ||||

| 2025-08-06 | 13F | Malaga Cove Capital, LLC | 47 964 | 0,21 | 972 | 10,97 | ||||

| 2025-06-18 | NP | RTXAX - Tax-Managed Real Assets Fund Class A | 59 152 | 0,00 | 1 151 | -0,61 | ||||

| 2025-08-12 | 13F | Covalis Capital Llp | 0 | -100,00 | 0 | |||||

| 2025-07-21 | 13F | Ping Capital Management, Inc. | 34 000 | 0,00 | 689 | 10,61 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 18 630 | -36,34 | 377 | -29,53 | ||||

| 2025-04-01 | 13F | Massmutual Trust Co Fsb/adv | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 19 506 | -5,40 | 395 | 4,77 | ||||

| 2025-06-03 | 13F | Invst, LLC | 33 551 | -28,03 | 614 | -29,46 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 48 704 | 63,81 | 987 | 81,25 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 19 210 | 389 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 71 304 | -22,64 | 1 445 | -14,35 | ||||

| 2025-08-14 | 13F | State Street Corp | 292 575 | -0,19 | 5 928 | 10,50 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 5 | -98,78 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 912 002 | -2,32 | 18 477 | 8,15 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 12 515 | 1,62 | 254 | 12,44 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 68 680 | 2,91 | 1 391 | 13,92 | ||||

| 2025-08-04 | 13F | Yorktown Management & Research Co Inc | 13 600 | 276 | ||||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 50 005 | -15,94 | 1 | 0,00 | ||||

| 2025-08-28 | NP | GII - SPDR(R) S&P GLOBAL INFRASTRUCTURE ETF | 68 075 | 6,50 | 1 379 | 17,96 | ||||

| 2025-08-14 | 13F | Quarry LP | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 17 018 | 21,51 | 345 | 34,38 | ||||

| 2025-06-27 | NP | ARGT - Global X MSCI Argentina ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 925 385 | -6,20 | 17 999 | -6,78 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 59 152 | 0,00 | 1 198 | 10,72 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 55 439 | -2,09 | 1 123 | 8,40 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 10 604 | -3,22 | 215 | 7,00 | ||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 16 308 | -10,51 | 330 | -0,90 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 20 000 | 58,73 | 405 | 76,09 | |||

| 2025-06-23 | NP | Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio | 42 104 | 0,24 | 819 | -0,49 | ||||

| 2025-08-13 | 13F | RWC Asset Management LLP | 75 387 | -21,72 | 1 527 | -13,34 | ||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 103 | 0,00 | 2 | 100,00 | ||||

| 2025-06-13 | NP | AIAFX - Aberdeen Global Infrastructure Fund Class A | 17 800 | 1,11 | 346 | 0,58 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 56 841 | 22,30 | 1 152 | 35,41 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 5 291 | 107 | ||||||

| 2025-08-14 | 13F | HighVista Strategies LLC | 62 000 | 2,99 | 1 256 | 14,08 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 182 153 | 13,93 | 23 950 | 26,13 | ||||

| 2025-08-13 | 13F | Options Solutions, Llc | 41 464 | 26,25 | 840 | 39,77 | ||||

| 2025-08-25 | NP | REVAX - RBC Emerging Markets Value Equity Fund Class A | 35 366 | 0,00 | 717 | 10,66 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 27 265 | -12,79 | 552 | -3,50 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 163 293 | 3,32 | 3 308 | 14,38 | ||||

| 2025-07-29 | 13F | LMG Wealth Partners, LLC | 98 050 | 3,01 | 1 986 | 14,07 | ||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 201 | 4 | ||||||

| 2025-08-27 | NP | FORH - Formidable ETF | 19 506 | -5,40 | 395 | 4,77 | ||||

| 2025-08-05 | 13F | Meixler Investment Management, Ltd. | 54 362 | 2,59 | 1 101 | 13,62 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 149 | 413,79 | 3 | |||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 26 821 | 0,00 | 543 | 10,82 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 22 000 | 0,00 | 446 | 10,70 | ||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 27 693 | -28,76 | 539 | -29,21 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 5 000 | 92,31 | 0 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 14 578 | 295 | ||||||

| 2025-08-12 | 13F | Inceptionr Llc | 10 625 | 215 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 3 402 | 69 | ||||||

| 2025-08-13 | 13F | Polen Capital Management Llc | 68 380 | 1 385 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 227 801 | 15,46 | 4 615 | 27,84 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 30 200 | 978,57 | 612 | 1 098,04 | |||

| 2025-08-13 | 13F | Quantbot Technologies LP | 1 240 | -54,63 | 25 | -50,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 66 966 | 1 973,89 | 1 357 | 2 198,31 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 634 064 | -5,67 | 12 846 | 4,43 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 56 | -40,43 | 0 | |||||

| 2025-05-13 | 13F | Liontrust Investment Partners LLP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 10 200 | 0,00 | 207 | 10,75 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 972 | 816,98 | 20 | 1 800,00 | ||||

| 2025-07-29 | NP | SMQFX - Siit Emerging Markets Equity Fund - Class A | 112 226 | 0,00 | 2 312 | 12,57 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 179 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 63 977 | 200,42 | 1 296 | 233,16 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 93 257 | 10,83 | 1 889 | 22,74 | ||||

| 2025-08-08 | 13F | Helikon Investments Ltd | 13 342 552 | -2,05 | 270 320 | 8,44 | ||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 63 613 | 49,46 | 1 289 | 65,55 | ||||

| 2025-08-01 | 13F | Davy Global Fund Management Ltd | 34 228 | 10,28 | 693 | 22,22 | ||||

| 2025-08-06 | 13F | Stokes Family Office, LLC | 224 050 | 0,67 | 4 539 | 11,47 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 12 026 | 0 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 65 051 | 328,84 | 1 318 | 375,45 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 395 | 2 533,33 | 8 | |||||

| 2025-04-07 | 13F | GAMMA Investing LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Fourth Sail Capital LP | 1 521 602 | -3,99 | 30 828 | 6,30 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 35 809 | -66,78 | 725 | -63,24 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 53 700 | 16,74 | 1 088 | 29,25 | |||

| 2025-08-19 | 13F | State of Wyoming | 5 589 | -37,91 | 113 | -31,10 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 14 600 | 296 | |||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 19 506 | -5,40 | 395 | 4,77 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 129 610 | 2 626 | ||||||

| 2025-08-08 | 13F | Allianz Se | 36 420 | 738 | ||||||

| 2025-08-26 | NP | MCTOX - Modern Capital Tactical Opportunities Fund Class A Shares | 13 000 | 0,00 | 263 | 10,97 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 139 327 | 2 823 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 1 184 948 | -0,08 | 24 007 | 10,62 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 10 600 | -3,64 | 215 | 6,47 | ||||

| 2025-08-14 | 13F | LRT Capital Management, LLC | 117 186 | 7,02 | 2 374 | 18,52 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 842 585 | 0,12 | 17 071 | 10,84 | ||||

| 2025-08-11 | 13F | Empirical Finance, LLC | 139 327 | 56,35 | 2 823 | 73,13 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 6 000 | -9,09 | 122 | 0,83 | ||||

| 2025-04-25 | 13F | Verity Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 6 895 | 6,14 | 140 | 17,80 | ||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 3 217 | 18,14 | 66 | 34,69 | ||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 40 807 | 827 | ||||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 421 700 | 0,33 | 8 544 | 11,08 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 183 | 0 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 10 570 | -2,43 | 214 | 8,08 |